Navigating Safety and Fairness in 2026

Key Takeaways

- Affordability checks UK are now a standard part of the licensed landscape, designed to trigger “light-touch” financial vulnerability assessments at specific net deposit thresholds.

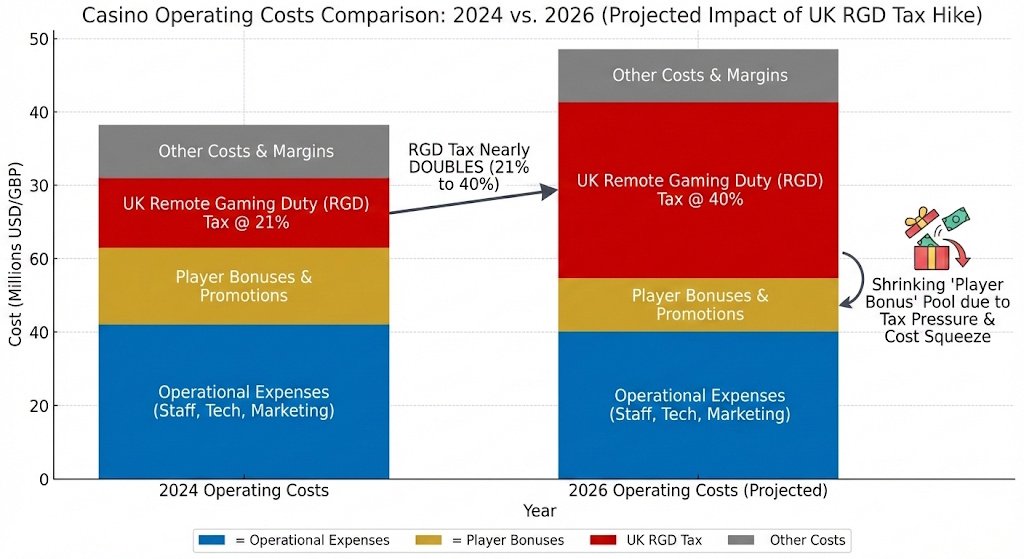

- The 2026 regulatory environment has seen a massive 40% Remote Gaming Duty (RGD) tax hike, which directly impacts the value of player bonuses and promotions.

- Understanding source of funds requirements is essential for high-volume players to ensure their accounts remain active and withdrawals are processed without delay.

The UK gambling landscape has shifted significantly as we move through 2026. If you have been asked to provide a bank statement or proof of income recently, you are not alone; it is the reality of a market governed by the strictest player protection rules in the world. Many players view these hurdles as an invasion of privacy, but they are the price of admission for a regulated, safe environment.

At The Casino Count, we believe in radical honesty. Whether it is the technical math behind a slot machine or the dry legal prose of a UK Gambling Commission (UKGC) update, our goal is to translate the “insider” knowledge into something you can actually use. This guide breaks down the friction points of modern gambling to show you what is actually happening behind the scenes.

What Are Affordability Checks in 2026?

Affordability checks are no longer the “wild west” of inconsistent operator demands. Following the 2024 White Paper implementations, most players now encounter “light-touch” financial vulnerability checks when they reach a net deposit of £150 in a single month. These are designed to be frictionless, often using third-party data to ensure you aren’t in active bankruptcy or under a debt relief order.

However, if your spending increases significantly, you will face more intrusive requests. Operators are legally required to verify that your gambling spend is proportionate to your discretionary income. If you find these rules confusing, you might want to brush up on your rights via The UK Gamblers’ Bill of Rights 2026 to see exactly what an operator can and cannot demand.

Why Does “Source of Funds” Feel Like an Interrogation?

While affordability is about whether you can lose the money, source of funds (SOF) is about where that money originated. This is a strict Anti-Money Laundering (AML) requirement that forces casinos to act like mini-banks. They are looking for evidence that the £5,000 you just deposited came from a legitimate salary, an inheritance, or a property sale.

The friction occurs because the UKGC has increased its enforcement budget. In late 2025, the regulator reported that industry GGY (Gross Gambling Yield) hit £16.8 billion, leading to even tighter scrutiny of high-value accounts. If you fail to provide a payslip or a dividend statement when asked, your account will be frozen—not because the casino wants to keep your money, but because they fear a multi-million-pound fine from the regulator.

The Truth About Slot Fairness: RNG vs. Reality

One of the most persistent myths in the The Casino Count Blog comments is the idea of “hot” and “cold” slots. You might feel like a game is “due” for a win after a long losing streak, but the mathematics of a Random Number Generator (RNG) says otherwise. Each spin is a statistically independent event, meaning the machine has no memory of the previous ten thousand spins.

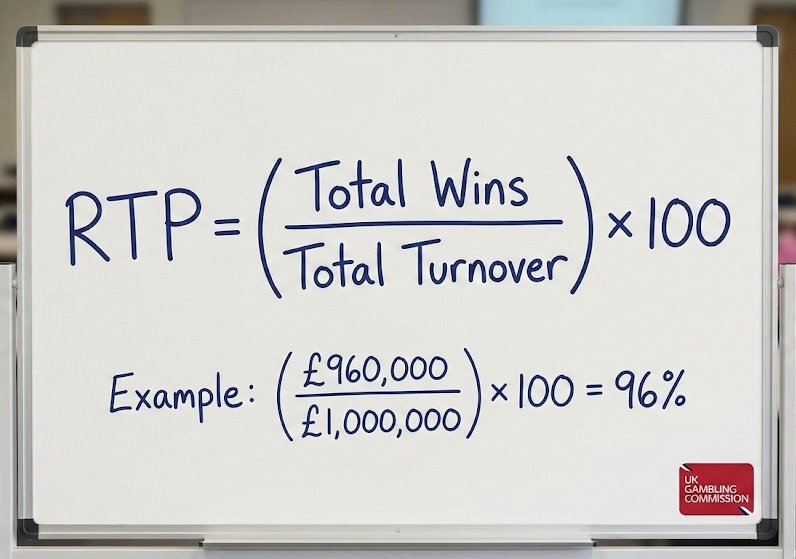

In the UK, the industry average for slot Return to Player (RTP) is approximately 96%. This is a theoretical figure calculated over millions of spins using the formula:

A slot with a 96% RTP still has a 4% house edge. Because of high variance, you can lose your entire bankroll in one session or hit a jackpot on your first spin. Neither of these outcomes means the game is “broken” or “hot”—it is simply the RNG operating within its programmed probability parameters.

How the 40% RGD Tax Impacts Your Bonus

You may have noticed that the generous 400% deposit bonuses of the early 2020s have vanished. The reason is simple: as of 1 April 2026, the Remote Gaming Duty (RGD) increased from 21% to 40%. This massive tax hike on online casino profits has forced operators to tighten their belts.

To remain profitable, casinos have had to reduce marketing spend and bonus values. The UKGC also stepped in on 19 January 2026, capping wagering requirements at 10x for many promotions to protect consumers. While this makes bonuses “fairer” and easier to understand, it also means the “free money” on offer is significantly lower than it used to be.

How to Navigate UKGC Regulations Safely

If you are new to the scene, the sheer volume of rules can be overwhelming. We recommend starting with our How To Play Casino Game Guides to understand the mechanics before you commit your hard-earned cash. Once you are playing, keep these three regulatory protections in mind:

- Gross Deposit Limits: From June 2026, all deposit limits must be “gross,” meaning they don’t reset just because you made a withdrawal.

- Wagering Caps: Never accept a bonus with a wagering requirement higher than 10x without checking the latest LCCP (Licence Conditions and Codes of Practice) updates.

- KYC Transparency: Operators must now be clearer about why they are asking for your ID, especially if the request happens at the withdrawal stage.

Responsible Gambling

Gambling should always be a form of entertainment, not a way to make money. If you feel like you are losing control or that the affordability checks UK operators are performing have highlighted a problem, reach out for help.

Resources like BeGambleAware.org, GAMSTOP, and BetBlocker provide free, confidential support and tools to help you stay in control. If it stops being fun, stop.

Why do I need to show my bank statement to a casino?

Casinos are required by the UKGC to perform affordability checks UK and verify your source of funds. This ensures that you are gambling with legitimate money that you can afford to lose, preventing both financial harm and money laundering.

Are online slots rigged in the UK?

No. All UK-licensed casinos must have their games tested by independent labs (like eCOGRA or iTech Labs) to ensure the RNG is truly random. The 96% RTP is a long-term average, not a guarantee for your specific session.

What happens if I refuse a source of funds request?

The tax is paid by the casino on their profits, not by the player on their winnings. However, it indirectly affects you because casinos may offer lower RTP versions of games or less valuable bonuses to offset the cost.

Can I set my own affordability limits?

Yes. Under current UKGC rules, operators must provide prominent tools for you to set daily, weekly, or monthly deposit limits. We strongly advise setting these before you even begin your first session.

Leave a Reply