Key Takeaways

- SOF documents are no longer optional; under 2026 UKGC regulations, operators must verify your income once specific deposit or loss thresholds are triggered.

- Proving income for casino accounts requires specific evidence, such as P60s, wage slips, or documentation of asset sales, to ensure compliance with anti-money laundering (AML) laws.

- The 2026 Gambling Bill of Rights empowers players to understand why these checks happen, yet the onus remains on the individual to provide “clear and verifiable” data.

Why Is the Casino Asking for My Bank Statement?

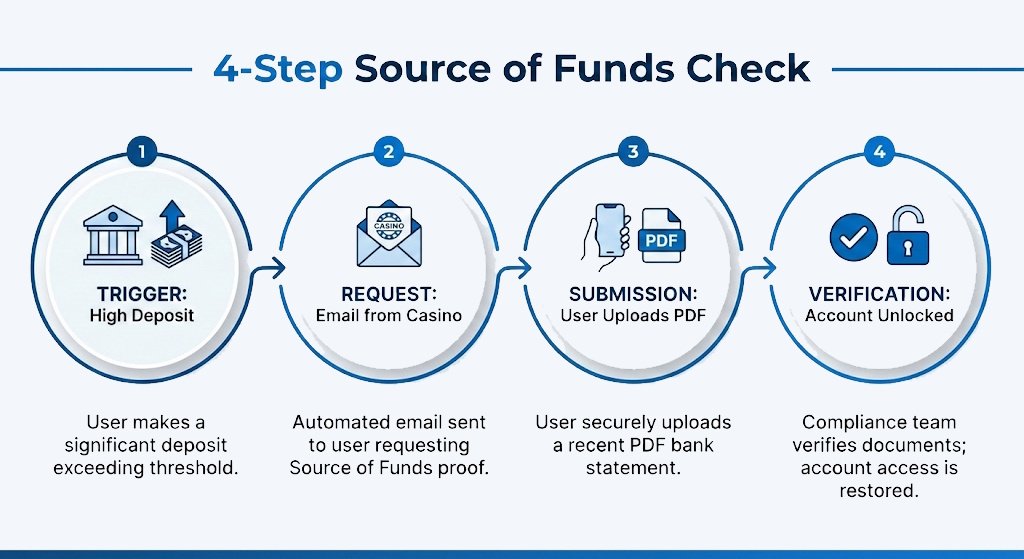

If you have ever been met with a locked account and a request for three months of bank statements, you have encountered a Source of Funds (SOF) audit. In 2026, these checks have become more stringent due to the latest UK Gamblers Bill of Rights 2026. The UK Gambling Commission (UKGC) has ramped up enforcement, with fines reaching new heights—such as the £2 million penalty issued to Paddy Power Betfair in late 2025 for social responsibility failures.

An SOF audit is not a personal attack or a sign that the casino thinks you are a criminal. It is a regulatory requirement designed to prevent money laundering and ensure that players are not gambling beyond their means. As your “Critical Friend,” I will tell you plainly: if you cannot prove where your money comes from, the casino is legally obligated to stop you from playing.

The 2026 SOF Checklist: What You Need to Provide

Navigating an audit is significantly easier when you have the right SOF documents ready. The UKGC expects operators to look for “consistency” between your spending and your known income. Here is the definitive list of what will satisfy a 2026 audit:

1. Employment Income

- Wage Slips: Usually the last three months of payslips.

- P60 or P45: To show your annual earnings and tax contributions.

- Director’s Dividends: If you are self-employed, a copy of your most recent audited accounts or a dividend voucher.

2. Personal Savings & Investments

- Bank Statements: Showing a clear history of savings accumulation over time.

- Investment Portfolios: Statements showing the sale of stocks, shares, or bonds.

- Crypto-to-Fiat: Documentation from a regulated exchange showing the original purchase and the subsequent withdrawal to your bank.

3. One-Off Windfalls

- Property Sale: A completion statement from your solicitor.

- Inheritance: A copy of the will or a letter from the executor of the estate.

- Gambling Winnings: Proof of payout from another licensed operator.

How To Pass Your Source of Funds Audit Instantly

We recommend these steps to ensure the casino doesn’t “sit” on your funds for weeks:

Use Digital PDFs

Never take a photo of a screen or a crumpled paper statement. Always download the official PDF from your banking app.

Match the Names

Ensure the name on your casino account is identical to the name on your bank statement. If you use a maiden name or a nickname, the automated systems will flag it.

Explain “Large” Deposits

If your bank statement shows a £5,000 transfer from a friend, the casino will ask about it. Proactively include a brief note explaining that it was a personal loan repayment or a shared holiday cost.

Check the “How To Play” Rules

Often, players trigger checks by trying to withdraw via a different method than they deposited. Review our How To Play Casino Game Guides to understand the “closed loop” payment policy.

Keep it Recent

Any document older than three months is usually rejected instantly. Always provide the most recent complete month of data.

Understanding the 2026 Trigger Points

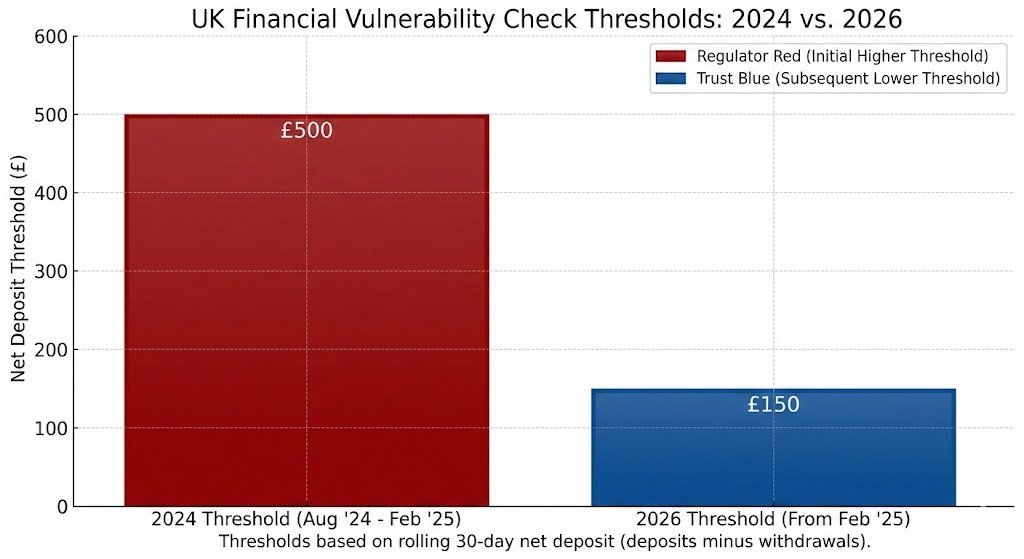

The UKGC has standardised the “frictionless” check system to identify vulnerability at an early stage. While the casino might not tell you exactly why they are auditing you, the 2026 regulations provide clear benchmarks.

- Light-Touch Vulnerability Check: Triggered if your net loss exceeds £150 in a rolling 30-day period. This check uses public data like bankruptcy records and usually happens without you needing to send files.

- Enhanced Financial Risk Assessment: Triggered by higher spend levels, typically around £500 in monthly net deposits. This is where you will be asked for specific documents to prove your funds are sustainable.

By June 2026, the new RTS 12B technical standards require all online operators to offer “gross” deposit limits as a default. This means your audit may be triggered by the total money put in, even if you have withdrawn an equal amount later that day. Before you hit these limits, it is wise to consult How To Play Casino Game Guides to understand how to manage your bankroll effectively.

New 2026 Regulations: RTS 12B and Financial Limits

As of 30 June 2026, the UKGC introduced updated Remote Gambling and Software Technical Standards (RTS 12B). This change mandates that “deposit limits” must now be based on gross amounts—the total you put in—rather than net amounts (deposits minus withdrawals).

This means that even if you are winning, you may still trigger an SOF check if your total deposits exceed the operator’s risk threshold. We have seen a shift where the “net deposit” model is now secondary to the “gross” model.

SOF vs. SOW: What is the Difference?

Many players confuse “Source of Funds” with “Source of Wealth.” Knowing the difference can save you from sending the wrong files and delaying your payout.

- Source of Funds (SOF): Focuses on the money for a specific deposit (e.g., your last month’s salary).

- Source of Wealth (SOW): Focuses on how you acquired your total net worth (e.g., long-term savings or a business sale).

- KYC (Identity): Proves you are who you say you are, typically using a passport or driving licence.

Debunking the Myth: Can “Hot” or “Cold” Slots Trigger Audits?

A common misconception among players is that a sudden “hot streak” on a slot machine will automatically trigger an SOF audit. While a massive win might prompt a “Source of Wealth” check before a withdrawal, the game’s mechanics have nothing to do with it.

Every legal slot in the UK uses a Random Number Generator (RNG) to ensure that every single spin is an independent event. There is no such thing as a “hot” slot that is “due” to pay out. The industry average for slot RTP (Return to Player) is approximately 96%, but this is calculated over millions of spins.

In the short term, the variance is what dictates your experience, not a hidden switch in the casino’s basement. If you want to dive deeper into how these systems work, visit The Casino Count Blog for our technical breakdowns.

Responsible Gambling

Gambling should be an entertaining pastime, not a source of financial stress. If you find yourself struggling to provide SOF documents because you are spending more than you can afford, it is time to seek help.

The UK offers world-class support through BeGambleAware.org, and you can use tools like GAMSTOP to self-exclude from all licensed operators. For software-based blocking on your devices, BetBlocker provides a free and effective solution.

Frequently Asked Questions (FAQs)

What happens if I refuse to provide SOF documents?

The operator is legally required to restrict your account. You will likely be able to withdraw your remaining balance (provided it isn’t flagged as criminal proceeds), but you will be blocked from further play.

Can I black out sensitive information on my bank statements?

Yes, you are usually permitted to black out your daily shopping habits or non-essential transactions. However, your name, account number, and the specific income sources (like your salary) must remain visible.

How long does an SOF audit take in 2026?

Most major operators aim to review documents within 24 to 48 hours. However, complex cases involving asset sales or overseas income can take up to five working days.

Is my data safe when I upload it?

UK-licensed casinos must adhere to strict GDPR and Data Protection Act 2018 standards. Your documents are stored on encrypted servers and are only accessible by the compliance and AML teams.

Leave a Reply