How Open Banking Is Changing Online Gambling

Key Takeaways

- Frictionless checks use open banking gambling technology to verify financial health without requiring manual document uploads.

- The UK Gambling Commission (UKGC) has phased in these checks to protect players from harm while maintaining a smooth user experience.

- Your data is protected by bank-level encryption, meaning casinos only see a risk score rather than your full transaction history or private spending habits.

The days of digging through drawers for dusty utility bills or screenshotting bank statements are coming to an end. For years, the “Know Your Customer” (KYC) process was the most frustrating part of online gaming, often feeling like a barrier between you and your winnings.

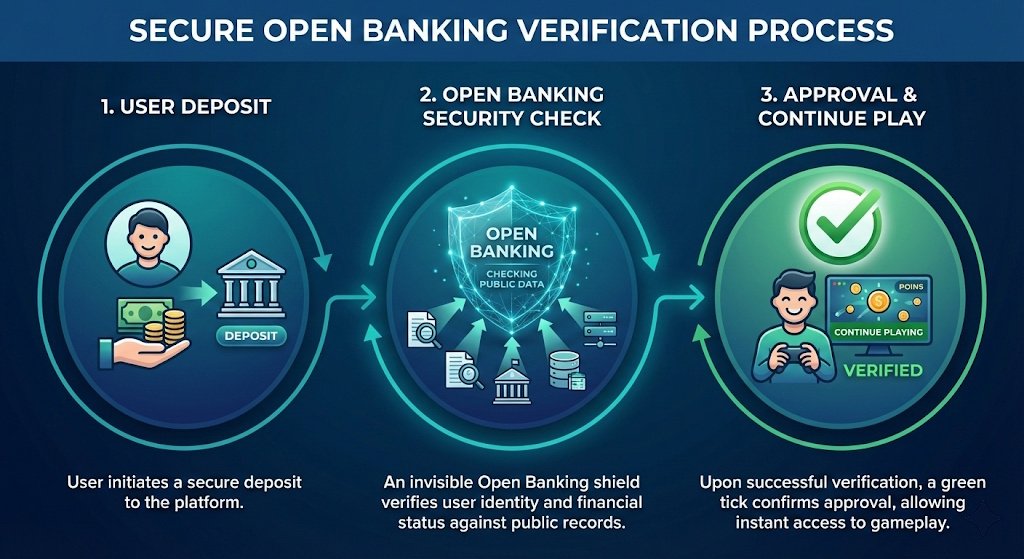

However, the industry has shifted toward a more streamlined approach known as the frictionless check. By leveraging the power of open banking gambling systems, operators can now verify a player’s identity and financial safety in seconds.

As we move into a new era of player protection, understanding your digital footprint is no longer optional. The shift toward automated verification is a core pillar of The UK Gambler’s Bill of Rights 2026, ensuring that your data is handled with the privacy and efficiency you deserve.

At The Casino Count, we believe that transparency is the foundation of a safe gaming environment. Understanding how these checks work is the first step in taking control of your digital footprint and your bankroll.

What is a Frictionless Check?

A frictionless check is an automated financial assessment that occurs in the background of your gaming experience. Unlike traditional “hard” checks that require you to send copies of your passport or bank statements, these assessments use secure data sharing to confirm you are gambling within your means.

The UK Gambling Commission (UKGC) introduced these measures to identify “acutely financially vulnerable” customers. As of February 2025, the threshold for a light-touch financial check was lowered to just £150 in net deposits within a rolling 30-day period.

These checks are designed to be “frictionless” because they don’t interrupt your play. In most cases, the operator uses a third-party credit reference agency to check for public records like bankruptcies or County Court Judgments (CCJs).

Why Does a Casino Want My Bank Statement?

It is a common source of anxiety: why does a casino need to see my private financial life? The answer usually falls into two categories: anti-money laundering (AML) and social responsibility.

Regulators require casinos to ensure that the money being spent is legitimate and that the player can afford the level of spend. If you reach a certain spending threshold, the casino is legally obligated to perform “Enhanced Due Diligence.”

Before the rise of open banking gambling tools, the only way to do this was to ask for a PDF of your bank statement. Today, many sites offer a digital alternative where you can grant one-time, read-only access to your account to prove your “Source of Funds” instantly.

Is Trustly Safe for Gambling?

When you see the option to “Pay N Play” or use Trustly, you are interacting with the gold standard of open banking. Trustly acts as a secure bridge between your bank and the casino, removing the need to share sensitive card details.

Trustly is an authorised Payment Institution regulated by the Swedish Financial Supervisory Authority and operates under strict FCA oversight in the UK. It uses the same high-level encryption as your high-street bank, making it significantly safer than traditional debit card entries.

The main benefit for the player is speed. Because the financial check and identity verification happen simultaneously during the deposit, withdrawals are often processed in minutes rather than days.

Does the Casino See My Salary?

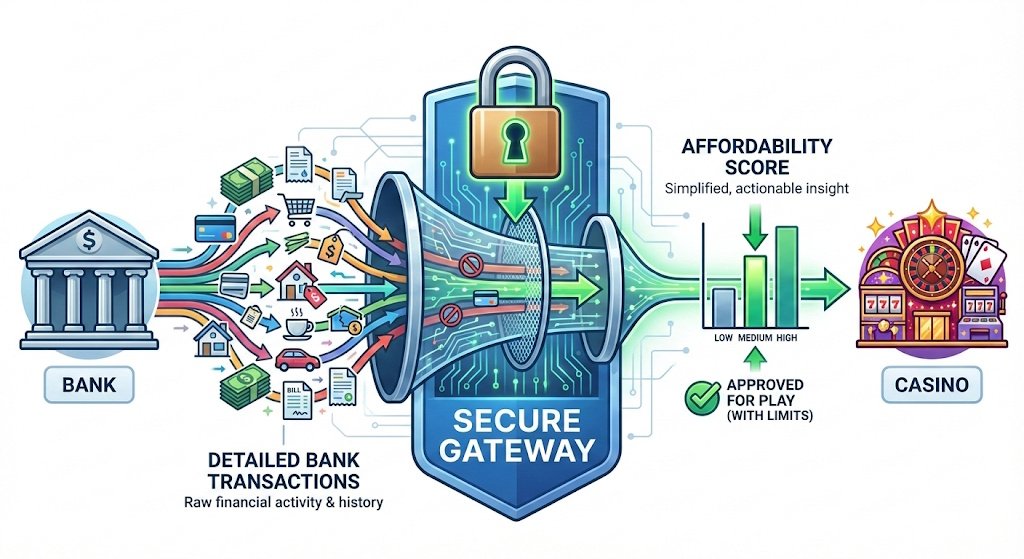

This is the biggest myth in the industry. When you consent to an open banking check, the casino does not get a “god mode” view of your bank account. They do not see that you spent £40 at a restaurant last night or exactly how much your employer pays you.

Instead, the third-party provider (like Trustly or TrueLayer) analyses your data and provides the casino with a simplified “Risk Flag.” This might be a “Red, Amber, or Green” status or a basic affordability score.

The goal is to confirm that your gambling spend is proportionate to your discretionary income. If you want to dive deeper into how to manage your budget, our A Practical Guide To Responsible Gambling provides a roadmap for staying in the green.

Debunking the “Hot” and “Cold” Slot Myth

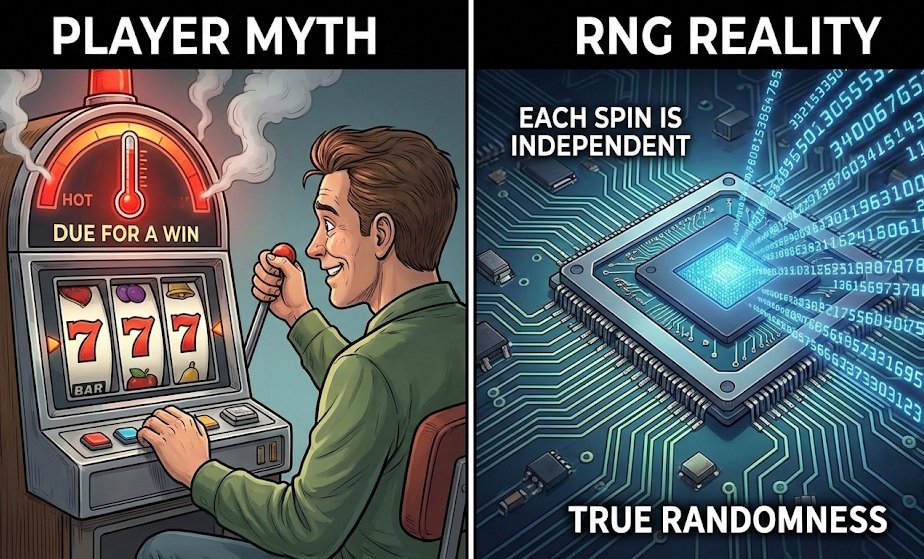

While we are on the subject of transparency, let’s address a common misconception regarding game fairness. Many players believe that if a slot machine hasn’t paid out in a while, it is “due” for a win (a “hot” slot) or that a machine that just hit a jackpot is “cold.”

This is mathematically impossible. Every licensed game uses a Random Number Generator (RNG) that resets with every single spin. The odds of hitting a jackpot on your first spin are identical to the odds on your thousandth spin.

Most online slots have a Return to Player (RTP) average of 96%. This is a long-term statistical average, not a guarantee for your specific session. For a better understanding of these mechanics, check out our How To Play Casino Game Guides where we break down the maths of every major game.

The Reality of Industry Regulation

The push for frictionless checks isn’t just a trend; it is a response to massive regulatory pressure. In the 2024/2025 financial year, the UKGC reported that the total Gross Gambling Yield (GGY) for the remote sector hit £7.8 billion.

With such huge sums of money moving through digital wallets, the risk of harm is real. The UKGC has issued record-breaking fines to operators who failed to conduct proper financial check procedures, sometimes reaching tens of millions of pounds.

By implementing open banking, casinos are trying to avoid these fines while protecting you. If an operator sees a player losing 90% of their monthly income in a single weekend, the system is designed to trigger an intervention before the situation spirals.

The Critical Friend’s View on Open Banking

We have to be honest: while frictionless checks are better than the old manual system, they are not perfect. Some players feel that even a “light-touch” check is an overreach of privacy.

However, the alternative is much worse. Without these automated systems, the UKGC would likely mandate even stricter, more intrusive manual checks for everyone. Open banking is the compromise that allows for a “safety net” without turning the casino lobby into a high-security checkpoint.

We recommend staying updated with the latest industry shifts by visiting The Casino Count Blog. We keep a close eye on how these technologies evolve so you don’t have to read through the 300-page regulator reports yourself.

Responsible Gambling Statement

Gambling should always be a form of entertainment, not a way to make money. If you find yourself worried about your spending or the frequency of your play, please take action. You can set deposit limits directly within your casino account or use tools like GAMSTOP to self-exclude from all UK-licensed sites. For free, confidential support, visit BeGambleAware.org or GamCare.

Will a financial check affect my credit score?

No. Frictionless checks and open banking assessments are “soft” searches. They do not leave a mark on your credit file and cannot be seen by lenders like mortgage providers or car loan companies.

Can I refuse an open banking check?

Yes, you have the right to refuse. However, if you hit the regulated spending thresholds, the casino may be forced to restrict your account or ask for manual documents (payslips/statements) instead.

How do I know if a casino is using my data correctly?

Only play at sites licensed by the UK Gambling Commission. These operators must comply with GDPR and the Data Protection Act 2018, ensuring your financial data is never sold or misused.

Does open banking work with all UK banks?

Most major UK banks, including Barclays, HSBC, NatWest, and digital banks like Monzo and Revolut, fully support open banking protocols used by providers like Trustly.

What happens if the check flags me as “at risk”?

The casino will typically reach out for a “Customer Interaction.” This might involve a simple chat to ensure you are comfortable with your spend, or they may suggest setting a deposit limit to keep your play sustainable.

Leave a Reply